The IRS has issued a new Form W-4 and updated its online withholding calculator to reflect this year’s revised...

Archive for category: Payroll

Milwaukee Area Employment Law Attorney: 200 South Executive Drive, Suite 101 Brookfield, WI 53005 Phone: 262-241-8444

Thinking About Using Payroll Debit Cards? Read This First

Janet L. Heins|News, Payroll, Relationship Management, Benefits, Compensation, Equal Pay, PaySome businesses may prefer paying workers with payroll debit cards rather than by check or direct deposit, but employers...

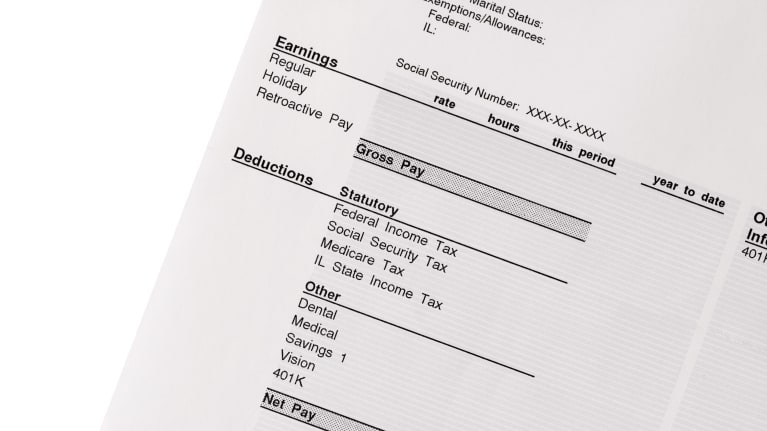

California Employers Face Significant Penalties for Pay Stub Violations

Janet L. Heins|California, Critical Evaluation, News, Payroll, Benefits, Compensation, Equal Pay, PayWhen California employers fail to accurately provide certain details on pay stubs, they might incur steep fines under state...

Going Paperless in California: Guidelines for Pay Stub Compliance

Janet L. Heins|Business Acumen, California, Compensation Compliance, News, Payroll, Benefits, Compensation, Equal Pay, PayIn a digital world, many employees no longer receive actual paychecks that they take to the bank to deposit—but...

Common Pay Stub Errors California Employers Should Avoid

Janet L. Heins|California, Compensation Compliance, Critical Evaluation, News, Payroll, Benefits, Compensation, Equal Pay, PayCalifornia HR professionals know the importance of promptly and accurately paying employees for all hours worked and that failing...

Home Depot’s Rounding Policy for Payroll Is OK

Janet L. Heins|California, Compensation Compliance, Critical Evaluation, News, Payroll, Benefits, Compensation, Equal Pay, PayHome Depot’s policy of rounding employees’ time punched in and out to the nearest quarter hour does not violate...

Beware of Form W-2 Phishing Scheme, Authorities Warn

Janet L. Heins|Critical Evaluation, Data Security, News, Payroll, Security, Benefits, Compensation, Equal Pay, PayAs tax season begins, the IRS is urging employers to educate their HR and payroll staff about a Form...

IRS Issues New Withholding Tables for 2018

Janet L. Heins|Communication, Compensation Communication, News, Payroll, Tax Compliance, Benefits, Compensation, Equal Pay, PayThe IRS has released updated income-tax withholding tables for 2018 that reflect changes made by the tax reform law...

SSA Revises Previously Announced Payroll Tax Cap for 2018

Janet L. Heins|News, Payroll, Tax Compliance, Benefits, Compensation, Equal Pay, PayOn Nov. 27, 2017, the Social Security Administration (SSA) announced that it had revised the maximum amount of earnings...

How to Comply with Payroll Record-Keeping Requirements

Janet L. Heins|Compensation Compliance, Managing Risks, News, Payroll, Benefits, Compensation, Equal Pay, PayComplex wage and hour laws are the source of both many headaches for HR and many class-action lawsuits from...

Categories

Contact – 262-241-8444

Recent Posts

Contact the Attorneys of H.E.L.P. – Heins Employment Law Practice Employee Rights Law Practice LLC for a Free Initial Phone Consultation. We serve EMPLOYEES AND PLAINTIFFS ONLY in Milwaukee, Whitefish Bay, Fox Point, Shorewood, River Hills, Hartford, Elm Grove, Pewaukee, Lake Geneva, Merton, West Bend, Brookfield, Waukesha, Menomonee Falls, Germantown, Fond Du Lac, Appleton, Manitowoc, Cedarburg, Port Washington, Grafton, Sheboygan, Green Bay and Madison Wisconsin on employee discrimination, retaliation, harassment, FMLA (Family Leave Medical Act), and employee rights.

We do not represent any employers, so you can be sure there will never be a conflict of interest. We can represent employees of private companies and federal employees all of the way to the Wisconsin Supreme court and beyond all of the way to U.S. Supreme Court if necessary.

Wisconsin Employment Attorneys Serving the Greater Milwaukee Area and Wisconsin For free consultation* or to set up an appointment with our team of dedicated employment law attorneys:

Contact our law firm online, Call our office at 262-241-8444 or Toll free at 866-241-8444

H.E.L.P. – Heins Employment Law Practice Employee Rights Attorneys

200 South Executive Drive, Suite 101

Brookfield, WI 53005

*There is no charge for your initial phone consultation.